Understanding Reliance General Insurance Co. Ltd: Your Go-To for Car Insurance

Introduction to Reliance General Insurance Co. Ltd

Reliance General Insurance Co. Ltd, a prominent player in the Indian insurance sector, was established in 2000 as a part of the Reliance group. The company has steadily positioned itself as a reliable choice for various insurance needs, particularly known for its comprehensive car insurance solutions. The mission of Reliance General Insurance is to provide insurance that empowers customers, ensuring they have the protection needed during unforeseen events. This commitment to safeguarding individual and business interests has allowed it to gain a loyal customer base over the years.

The vision of Reliance General Insurance revolves around being the most admired insurance provider in the country, facilitating customer-centric innovations that enhance user experience. By continually investing in state-of-the-art technology and customer service, the company strives to simplify the insurance process for policyholders. This attention to service excellence reflects in their high customer satisfaction ratings, making them a notable competitor in the car insurance segment.

Another critical aspect of Reliance General Insurance’s business strategy is its focus on customer support and transparency. The company endeavors to educate its clients about different insurance products, enabling them to choose plans that accurately fit their needs. Their reputation in the market is complemented by a robust claims settlement process, ensuring a hassle-free experience when customers need to make a claim.

In a country where car ownership has surged, Reliance General Insurance Co. Ltd has played an integral role in promoting responsible driving through adequate coverage options. The firm’s dedication to quality services positions it as a vital component in the expansive Indian insurance landscape. Its comprehensive offerings continue to meet the evolving demands of consumers, reinforcing its status as a go-to choice for car insurance in India.

Types of Car Insurance Policies Offered

Reliance General Insurance Co. Ltd provides a diverse range of car insurance policies, catering to the different needs of vehicle owners. Among the most common types of car insurance policies are third-party liability insurance and comprehensive insurance, each offering unique benefits and coverage options.

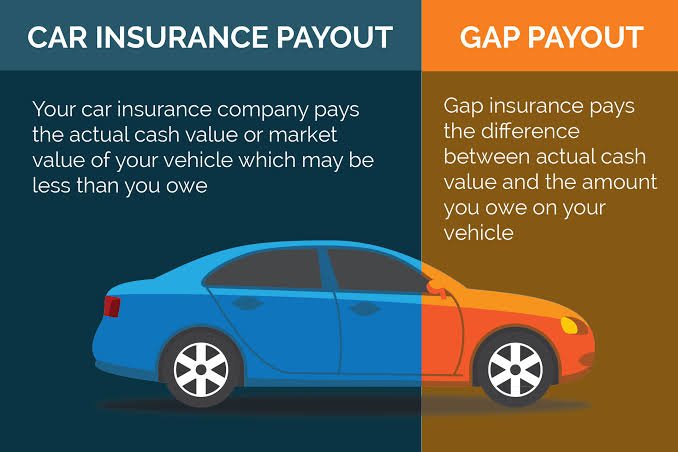

Third-party liability insurance is designed to cover damages caused to another party in the event of an accident. This policy is mandatory under Indian law for all vehicle owners and serves to protect the insured from legal liabilities arising from injury or property damage inflicted on third parties. Importantly, this type of insurance does not cover damages to the insured’s vehicle or injuries sustained by the driver. It is particularly beneficial for those seeking budget-friendly options while ensuring compliance with legal requirements.

On the other hand, comprehensive insurance offers a more extensive level of protection. This policy not only covers third-party liabilities but also protects the insured’s vehicle against damages from natural disasters, theft, vandalism, and accidents. Comprehensive insurance provides peace of mind for policyholders who wish to safeguard their asset against various unforeseen incidents. Additionally, many insurers, including Reliance General, offer add-ons such as personal accident cover and zero depreciation cover, enhancing the overall protection provided.

Reliance General also recognizes the importance of customized solutions by offering tailored policies that meet specific needs. For instance, they provide features like coverage for electrical and non-electrical parts, as well as options for coverage during long-distance travel. By understanding the various types of car insurance policies available, customers can make informed decisions that align with their individual requirements and budgetary constraints.

Pricing Structure of Car Insurance

The pricing structure of car insurance at Reliance General Insurance Co. Ltd is formulated based on several critical factors that contribute to the overall cost of premiums. Understanding these determinants will allow prospective policyholders to make more informed decisions regarding their car insurance choices. Key elements influencing the pricing include the age of the driver, driving history, and the type of vehicle insured.

Age plays a significant role in the calculation of insurance premiums. Generally, younger drivers tend to face higher premiums due to their lack of experience on the road, which statistically correlates with a higher likelihood of accidents. Conversely, older drivers may benefit from lower rates, provided they have maintained a clean driving record over the years. Additionally, those with a history of safe driving, characterized by minimal claims and traffic violations, often receive favorable premium rates. This reflects the principle that a driver with a proven track record of responsible behavior is deemed a lesser risk to insurers.

The type of vehicle insured also greatly impacts pricing. Vehicles that have high repair costs or are more likely to be targeted for theft typically attract higher premiums. For instance, luxury vehicles and high-performance cars may incur higher insurance costs, whereas more economical models might yield more affordable rates. In comparison to competitors, Reliance General Insurance often provides competitive pricing, reflecting a balance between comprehensive coverage and customer needs. By analyzing these price determinants, individuals can better apprehend the pricing model utilized by Reliance General Insurance, allowing them to navigate the complexities of car insurance more easily.

Policy Duration and Renewals

Reliance General Insurance Co. Ltd offers a variety of car insurance policies characterized by flexible durations that cater to individual customer needs. Typically, the standard validity period for a car insurance policy in India is one year; however, some options may allow for multi-year policies, which can provide increased convenience and cost savings over time. Policyholders can choose the duration that best suits their requirements while ensuring compliance with regulatory mandates.

The renewal process for car insurance policies is designed to be straightforward. Policyholders receive notifications from Reliance General Insurance well in advance of their policy expiration date, allowing ample time to review their coverage and decide on any necessary adjustments. Timely renewals are crucial, as they ensure continuous coverage without any lapses that could expose the driver to financial risks in the event of an accident or damage. Moreover, a lapse in coverage could potentially lead to difficulties when applying for future insurance policies, as insurers may view it unfavorably.

To further streamline the experience, Reliance General Insurance has introduced auto-renewal options. Customers can opt for this feature during the initial policy purchase, ensuring that their car insurance is automatically renewed at the end of the coverage period. This not only eliminates the need for manual intervention but also serves to prevent any inadvertent lapses in coverage. Nevertheless, it is essential for policyholders to keep their payment methods updated to avoid any interruptions in the renewal process.

In conclusion, understanding the duration of car insurance policies and the renewal process is vital for maintaining adequate coverage. By utilizing the available options, including auto-renewal, customers can enhance their insurance experience and ensure peace of mind on the road.

Discounts and Offers Available

Reliance General Insurance Co. Ltd offers a variety of discounts and promotional deals specifically designed to benefit customers purchasing car insurance. These benefits not only lower the overall premium but also encourage safer driving behaviors among policyholders. One of the most notable discounts is the no-claim bonus. This reward is granted to policyholders who do not file any claims during the policy period, resulting in significant savings upon renewal. The no-claim bonus increases with each consecutive claim-free year, fostering a sense of responsibility and prudence in driving.

Furthermore, customers are also eligible for discounts when they opt to purchase their car insurance online. Reliance General Insurance promotes online transactions by providing an exclusive discount, thereby reducing administrative costs and enhancing customer convenience. This approach not only modernizes the purchasing process but also provides tangible savings, making it a beneficial option for many drivers. By organizing insurance needs through the website, customers can effectively compare different policy options and gain direct access to promotional rates.

In addition to these, policyholders may also enjoy discounts for bundling multiple insurance policies, such as home and auto insurance. This multi-policy discount rewards clients who choose to consolidate their insurance needs under one provider, facilitating easier management of premiums while also providing savings. These offers are instrumental for families or individuals with various assets requiring coverage, ultimately enhancing financial security.

Overall, Reliance General Insurance Co. Ltd is committed to providing competitive premiums through a range of discounts that cater to a broad spectrum of customers. By leveraging these discounts, customers can significantly reduce their car insurance costs while enjoying adequate coverage tailored to their needs.

Claim Process for Car Insurance

The claim process for car insurance with Reliance General Insurance Co. Ltd is designed to assist policyholders in navigating through potentially stressful situations following an accident or theft. Understanding the steps involved can make this experience smoother and more efficient. Initially, it is crucial to report the incident to the nearest police station if it involves an accident leading to injury or theft. Obtain a copy of the First Information Report (FIR) as it will be necessary for further processing.

Once the incident is documented, policyholders should notify Reliance General Insurance as soon as possible. This can typically be done through their customer service hotline or online portal. Upon notifying the insurer, a claim form must be filled out, detailing the specifics of the incident, including the location, time, and nature of the damage or loss incurred. Ensure that all required details are accurately provided to avoid delays.

Documentation is a critical aspect of the claim process. Ensure to gather and submit the following: the completed claim form, a copy of the FIR, photographs of the damage, the vehicle registration document, and previous policy documents. Providing comprehensive documentation will expedite the claim review process. Once the claim is submitted, Reliance General Insurance aims to conduct a preliminary assessment and may appoint a surveyor to evaluate the damages within a stipulated timeframe, typically 24 to 72 hours.

After assessment, the insurer will communicate the status of the claim. For a smoother claims experience, policyholders should keep track of all communications with the insurer and respond promptly to any requests for further information. Understanding the timeframe for processing claims can also help in managing expectations. Generally, the claim amount may be settled within a few days to several weeks, depending on the nature and complexity of the claim. Knowing these essential steps and tips can significantly aid policyholders during their claims process.

Customer Support and Assistance

Reliance General Insurance Co. Ltd. prioritizes customer satisfaction by offering a comprehensive support system tailored to meet the needs of its policyholders. The company provides various contact channels to ensure that clients can easily access assistance when required. Customers can reach Reliance General Insurance through multiple avenues including phone, email, and live chat. The dedicated customer care team is available to address inquiries, provide policy information, and assist with claims processing.

Phone support is easily accessible, with a toll-free number that operates during business hours to facilitate quick communication. For customers preferring written communication, email support is available, allowing for detailed inquiries where the customer can articulate their questions or concerns at their own pace. Additionally, the live chat feature on the company’s website provides real-time support, which is particularly beneficial for customers who need immediate assistance. This multi-channel approach emphasizes Reliance General Insurance’s commitment to being responsive to its clients’ needs.

The support team is well-trained to provide assistance on various topics, including policy coverage, renewal processes, and the claims procedure. This knowledge ensures that customers can have their problems addressed efficiently, improving their overall experience with the company. Testimonials from satisfied customers frequently highlight the professionalism and prompt responses of the support staff, reinforcing the reliability of Reliance’s customer assistance. In today’s competitive insurance market, such a robust support framework positions Reliance General Insurance as an exemplary provider of customer service and assistance.

Comparative Analysis with Other Insurers

When evaluating car insurance providers in India, it is essential to compare Reliance General Insurance Co. Ltd with other major players in the market. This comparative analysis focuses on key differentiators, user satisfaction ratings, and both the advantages and disadvantages associated with these insurance companies.

Reliance General Insurance has established a strong reputation, particularly for its comprehensive car insurance plans that cater to a wide range of customer needs. The insurer is known for its competitive premium rates, extensive coverage options, and a solid network of cashless garages. When pitted against competitors such as ICICI Lombard, HDFC ERGO, and Bajaj Allianz, Reliance often fares well in terms of customer service and claims settlement efficiency. Many customers have reported a hassle-free experience in their interactions, leading to high satisfaction ratings.

However, it is important to consider the trade-offs. While Reliance’s premium rates might be appealing, some consumers have pointed out limited add-on coverage options compared to other insurers. In contrast, Bajaj Allianz offers a wider range of customizable add-ons, potentially providing greater flexibility for those looking for tailored coverage. On the other side, HDFC ERGO excels in quick claim processing but might come with slightly higher premiums.

In terms of financial stability and trustworthiness, Reliance holds a competitive position, often scoring well in various customer review platforms. However, some customers express concerns about the claim settlement process, particularly regarding documentation requirements. Therefore, while Reliance General Insurance offers an attractive package, consumers should weigh their specific needs against the offerings from other insurers to find the best fit for their car insurance requirements.

Conclusion: Making the Right Choice

When navigating the complex landscape of car insurance, Reliance General Insurance Co. Ltd stands out as a reputable provider with a diverse range of offerings tailored to meet the varied needs of its customers. Their policies not only offer comprehensive coverage for vehicles but also include options for personal accident cover and third-party liability, addressing the different aspects of car insurance that matter to policyholders. Understanding these offerings is essential for making an informed decision.

Importantly, potential customers must acknowledge that selecting the right car insurance policy involves a careful assessment of individual preferences and requirements. While Reliance General Insurance presents compelling offerings, it is vital to compare policies from various insurers to ensure that you find the best fit for your specific situation. Factors such as premium costs, coverage limits, and specific exclusions should be key considerations during this evaluation process.

Additionally, customers are urged to take advantage of the resources provided by Reliance General Insurance, including personalized quotes and expert guidance available through their customer service channels. By doing so, you can facilitate a better understanding of what each policy entails and how it correlates with your particular needs. An informed choice will ultimately lead to enhanced peace of mind while on the road.

In conclusion, whether you are a new driver or an experienced one seeking to update your coverage, Reliance General Insurance Co. Ltd offers a variety of suitable options. By taking the time to analyze your circumstances and compare available policies, you will be equipped to make the right choice in selecting your car insurance, ensuring financial protection and confidence while driving.